Do I Need to Pay Taxes on Winnings from a Cryptocurrency Casino?

The rise of cryptocurrency has not only transformed the way we think about money but also how we engage with the digital economy, including online gambling.

Crypto online casinos have become a popular means for many to try their luck, offering the promise of anonymity, security, and fast transactions. However, one question that frequently arises among players is whether they need to pay taxes on their winnings from these platforms.

This cryptoonline.casino article explains what you need to know about the tax obligations related to gambling winnings from a crypto casino online, providing clarity on this complex subject of taxing cryptocurrency winnings, and taxing crypto at all for that matter. The topic deserves a close examination and that’s what we’ve delivered. Let’s dive in further.

Tax Obligations on Gambling Winnings: A Global Overview

The taxation of gambling winnings is a complex topic that varies widely across different jurisdictions. Whether you’re using traditional fiat currency or cryptocurrencies like Bitcoin for online gambling, the fundamental question of tax liability hinges on the laws of the country in which you reside. Let’s explore the nuances of gambling tax obligations in various regions around the globe, highlighting the diversity in regulations.

Tax Laws in the United States

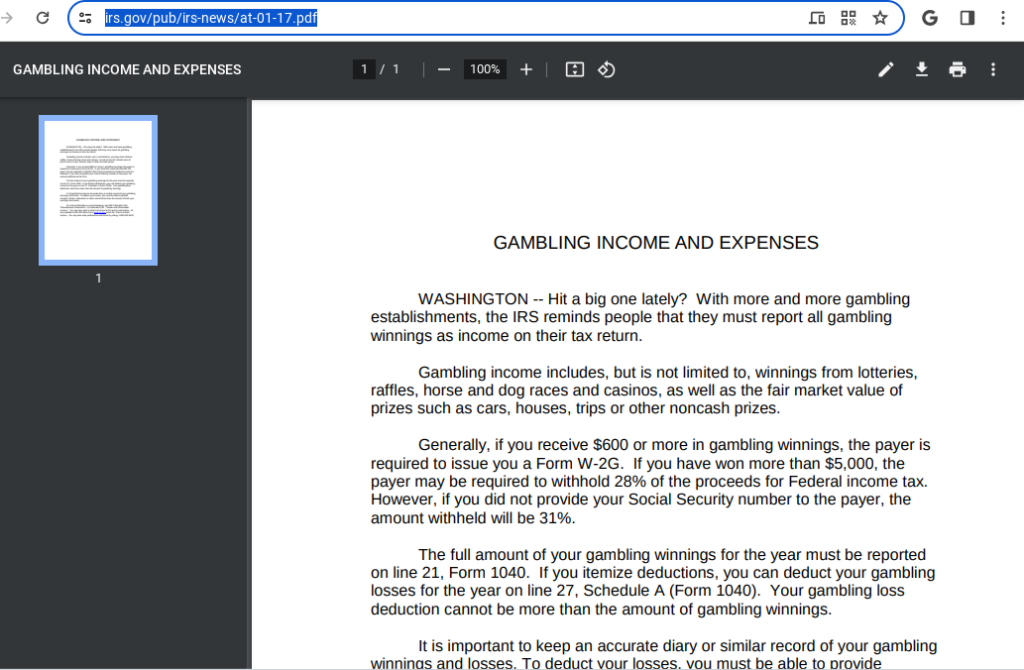

In the United States, the Internal Revenue Service (IRS) mandates that all gambling winnings, regardless of the amount, are taxable income. This includes winnings from casinos, sports betting, lotteries, and even online crypto gambling platforms. Gamblers are required to report their winnings on their tax return using Form W-2G if they receive certain types of winnings or have any gambling winnings subject to federal income tax withholding.

European Union: A Diverse Landscape

Taxation on gambling winnings within the European Union varies significantly from one member state to another:

- United Kingdom: The UK does not tax gambling winnings for its residents, thanks to a policy designed to tax the operators rather than the players. This applies to all forms of gambling, from online casinos to sports betting.

- Germany: In Germany, professional gamblers must pay taxes on their winnings as their gambling activities are considered a form of self-employment. Casual gamblers, however, are not taxed on their winnings.

- France: France imposes taxes on gambling winnings from sports betting, horse racing, and poker over a certain amount. However, casino winnings are not taxed.

Canada’s Approach

Canada generally does not tax gambling winnings unless they are considered income from a business. This means that for the vast majority of Canadian gamblers, winnings from crypto online casinos are not taxable. However, professional gamblers who make a living from their gambling activities are required to pay taxes on their earnings.

Australia’s Stance

Similar to Canada and the UK, Australia does not tax gambling winnings for recreational gamblers. The Australian Taxation Office (ATO) views gambling as a hobby or recreational activity, not a form of income that could be taxed. However, professional gamblers must include their winnings as income on their tax return.

Asia, Africa, and Latin America: Varied Regulations

The tax treatment of gambling winnings in Asia, Africa, and Latin America varies widely:

- Singapore: Singapore taxes its permanent residents on gambling winnings from local operators but not on overseas or online winnings.

- South Africa: South Africa imposes a 15% tax on gambling winnings above a specific threshold.

- Brazil: Brazil currently does not tax gambling winnings, as most forms of gambling are illegal. However, this might change with the legalization and regulation of certain types of gambling.

Tax Implications for Crypto Gambling Winnings

When it comes to cryptocurrency gambling winnings, the tax implications become even more complex due to the evolving nature of crypto regulations. Generally, if a country treats cryptocurrencies as taxable assets, then gambling winnings in crypto are subject to the same tax regulations as winnings in fiat currency. This means you would need to convert the value of your crypto winnings to your local currency at the time of the win and report it as income or gains, depending on your country’s laws.

Navigating Global Gambling Taxation

Given the wide range of tax treatments for gambling winnings around the world, it’s crucial for gamblers to familiarize themselves with the specific laws and regulations in their country. Keeping detailed records of winnings and losses, understanding the distinction between recreational and professional gambling, and consulting with a tax professional can help navigate the complexities of gambling taxation, ensuring compliance and avoiding potential penalties.

Taxation on gambling income varies by jurisdiction, often involving complex laws and regulations. Below, I’ve compiled a selection of official quotes from various authoritative sources regarding the taxation of gambling income. These quotes provide insights into the general stance and specific rules applied in different regions. Note that the specifics can change, so it’s always best to consult the latest guidelines from the relevant tax authority or a tax professional.

- United States Internal Revenue Service (IRS): “Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings from lotteries, raffles, horse races, and casinos.”

- Canada Revenue Agency (CRA): “In general, gambling proceeds are not considered taxable income unless you are considered a professional gambler where gambling can be viewed as a business activity.”

- Australian Taxation Office (ATO): “Most of the time, winnings from gambling are not taxable. However, if you are gambling with the intention of making a profit, then your winnings can be considered income and may be taxable.”

- Her Majesty’s Revenue and Customs (HMRC), UK: “You do not have to pay tax on gambling winnings in the UK. However, professional gamblers, considered to be trading, may be liable to income tax.”

- Revenue Commissioners, Ireland: “Winnings from betting or playing lotteries are not taxable. However, an individual’s professional gambling activities, carried on in a business-like manner, may be subject to tax.”

- South African Revenue Service (SARS): “Winnings from gambling activities are generally exempt from Income Tax. However, winnings from gambling can be considered capital in nature and could be subject to Capital Gains Tax.”

- New Zealand Inland Revenue Department: “Prize money received from gambling is not taxable unless you receive it as a regular source of income.”

- German Federal Ministry of Finance: “Winnings from gambling are not subject to income tax as long as they are not derived from a source that is considered professional or habitual.”

- Finland Tax Administration: “Lottery winnings are tax-exempt. However, income generated from professional gambling activities is taxable.”

- Swedish Tax Agency (Skatteverket): “There is no tax on gambling winnings from casinos or central betting companies in Sweden. However, winnings from gambling abroad might be subject to tax.”

These quotes illustrate a wide range of approaches to the taxation of gambling income worldwide. Some countries focus on the distinction between professional and recreational gambling to determine tax liability, while others exempt gambling winnings from income tax altogether. Always, the context and specifics of individual circumstances significantly influence taxation requirements.

Bottom Line

The taxation of gambling winnings, especially from online crypto casinos, is a subject with significant variation across jurisdictions. Understanding your tax obligations based on your residence and the nature of your gambling activities is essential. As the landscape of online gambling and cryptocurrency continues to evolve, staying informed about the latest tax laws and regulations in your country is more important than ever.

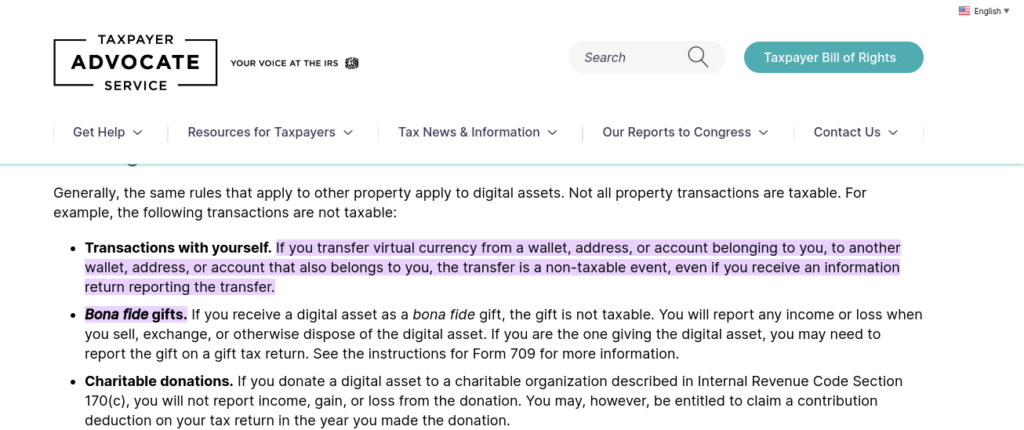

Cryptocurrency is Considered Property

In jurisdictions like the US, the Internal Revenue Service (IRS) treats cryptocurrencies as property for tax purposes. This means that any transaction involving crypto, including gambling winnings, can trigger a taxable event. When you win crypto at an online casino, you are essentially acquiring property that has a fair market value, which should be reported as income.

Reporting Winnings and Losses

It’s crucial to keep detailed records of your gambling activities, including the dates of transactions, the types of gambling, the crypto used, and the amount won or lost. These details are essential not only for tax reporting purposes but also to track your financial performance over time.

Capital Gains and Losses

If you withdraw your winnings in crypto and later sell that crypto for fiat currency, any increase in the value of the cryptocurrency from the time you won it to the time you sell it could be subject to capital gains tax. Conversely, a loss could potentially be deducted, depending on your country’s tax laws.

How to Report Crypto Gambling Winnings

Reporting your winnings correctly involves several steps:

- Determine the Fair Market Value: You need to calculate the fair market value of your winnings in your local currency on the day you received them.

- Report as Income: Include the fair market value of your winnings on your tax return as income.

- Consider Capital Gains or Losses: If you later sell the crypto, you must report any capital gain or loss from the transaction.

Bottom Line

While the anonymity of crypto casinos might seem appealing, it’s essential to remember your tax obligations. Failing to report gambling winnings, including those in cryptocurrency, could lead to penalties and interest on unpaid taxes. It’s always best to consult with a tax professional to understand your specific obligations and ensure compliance with your local tax laws.

FAQ

Q: Are all gambling winnings taxable?

A: Yes, in many countries, all gambling winnings are considered taxable income, but the specifics can vary.

Q: Do I need to report my crypto gambling winnings if I don’t convert them to fiat currency?

A: Yes, the winnings are taxable at the time of acquisition, regardless of whether you convert them to fiat currency.

Q: How do I calculate the value of my crypto winnings?

A: You must determine the fair market value of the cryptocurrency in your local currency on the day you received it.

Q: Can I deduct gambling losses?

A: In some jurisdictions, you can deduct gambling losses up to the amount of your winnings, but you cannot deduct losses beyond your winnings.

Q: What if I gamble on a site that doesn’t provide tax documents?

A: You are still responsible for reporting your winnings and calculating the fair market value yourself.

Q: Does it matter if the online casino is located overseas?

A: No, your tax obligations are based on your residency and citizenship, not the location of the casino.

Q: What records should I keep?

A: Keep detailed records of all gambling transactions, including the date, type of gambling, amount wagered, amount won or lost, and the cryptocurrency used.

Q: Can failing to report gambling winnings lead to legal consequences?

A: Yes, failing to report income, including gambling winnings, can result in penalties, interest, and even legal action.

Related Reading

For further reading on this topic, consider these resources:

- IRS Guidance on Virtual Currencies: Provides detailed information on how the IRS views cryptocurrency transactions, including gambling winnings.

- IRS: Choosing a Tax Professional: Consulting with a tax professional can provide personalized guidance tailored to your situation.

Understanding your tax obligations when it comes to gambling winnings from crypto online casinos is crucial. By staying informed and compliant, you can enjoy your gaming experience without unexpected tax complications.